Free budgeting resources for kids and youth

You can deliver engaging financial education tailored to young people that helps them in managing their money with our free, downloadable teaching resources. You don’t need to be an expert in money – we’ll provide everything you need to deliver powerful, practical sessions that make a real difference now and into the future.

What our resource packs include

Access your free kids and youth resources today

Get the resources

Answering your questions

Everyone! If you’re a parent, teacher, youth worker or homeschooler, you can help your children or dependents understand where money comes from. Wherever you’re working with children and youth, these budgeting resources can help.

No! The great thing about these resource packs is that they’ve been created to make your teaching experience stress-free. In each pack, you’ll find a step-by-step lesson plan filled with information on how to prepare for your session, resources, suggested answers to questions, learning objectives and guidance on timings.

You can access all of these brilliant budgeting resources for free! Just complete this form, and you’ll receive an email with the download links and instructions.

Our kids and youth budgeting resources are designed for children of all different ages. Ensure progression of skills by using our resources for children aged 9–11, and find adapted, more mature content for teenagers aged 14–16. Feel free to have a look at the materials and decide if they’re suitable for your children’s needs.

See what’s included in our money teaching resources

Scenario cards

Spark engaging conversations with your children and encourage them to talk about money with our scenario cards. Perfect to use during starter activities in groups or pairs, you’ll get children’s brains working to think about how they prioritise their spending.

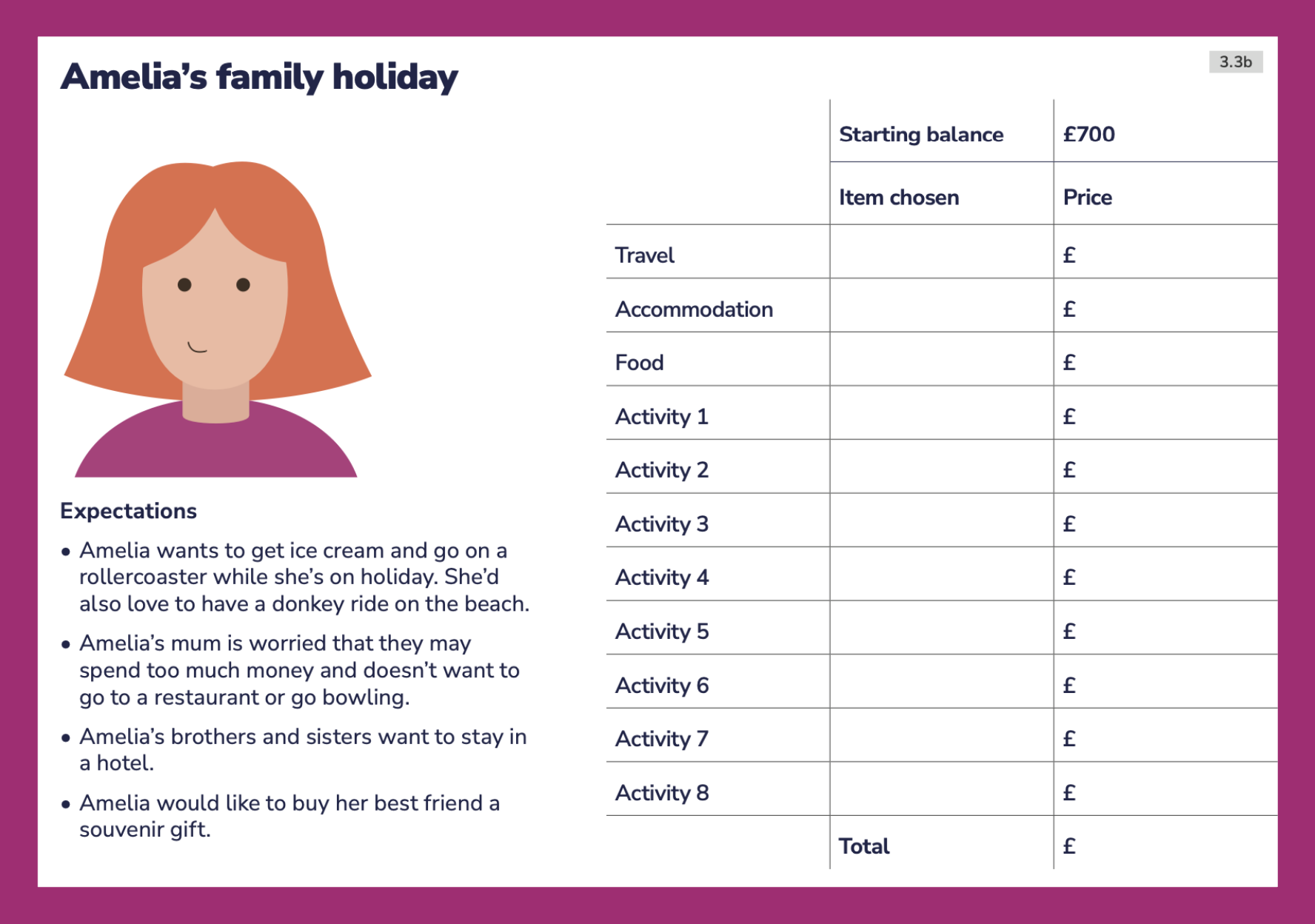

Budgeting worksheets

Put learning into practice with engaging, easy-to-understand budgeting worksheets and the help of our friendly characters.

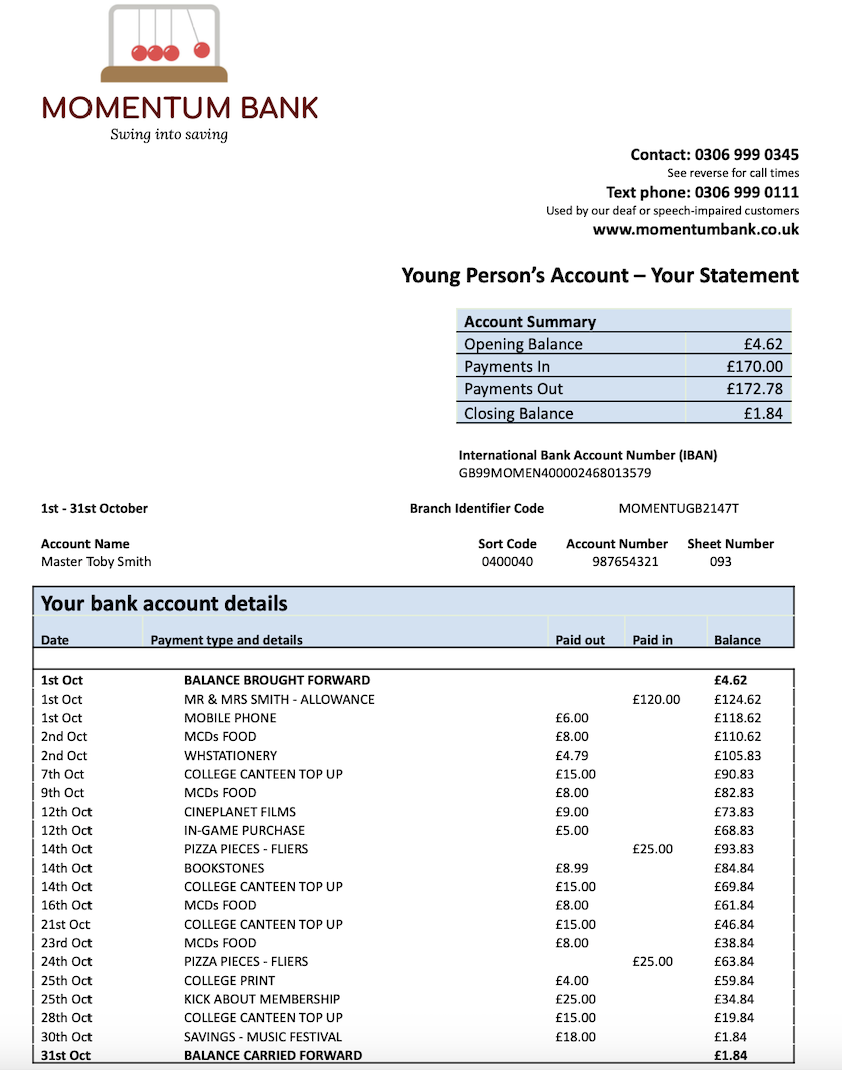

Real-world examples

Set older children up for success by using our activities that replicate money management in the real world. You’ll help children build strong connections to learn how money really works, reinforcing their understanding.

Tried and tested

Hear what others have to say about our budgeting resources:

We’re acutely aware that as our teenage girls are getting older, we need to prepare them for more than just how to spend the small amount of pocket money that they get each week. These materials have enabled us to open up conversations about things like the consequences and dangers of getting into debt, alongside the benefits and rewards of saving for the future.

Rachel