Since the start of 2025 Ofgem, the independent energy regulator, tasked with protecting consumers and ensuring a fair and competitive energy market, has been busy publishing policy proposals designed to support some of the low income households in the UK. Here’s what Kiri and Ali from Christians Against Poverty (CAP) think about the proposals.

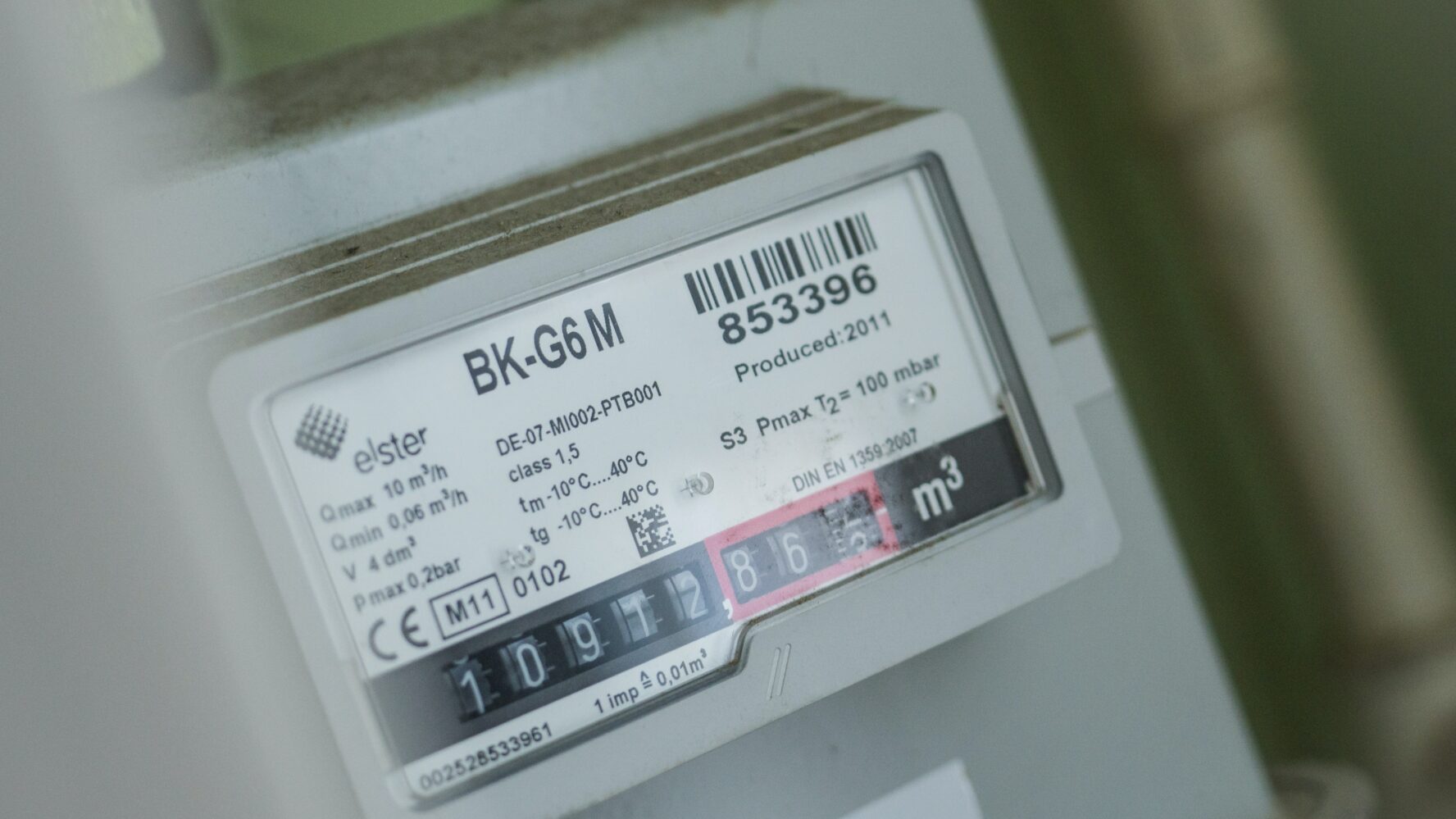

The daffodils are here, a welcome sign of spring. But for many households across the UK, the warmth of the sun is overshadowed by the chilling reality of rising energy costs. National Energy Action (NEA) estimates that 6.1 million households across the UK were in fuel poverty in 2023. CAP (Christians Against Poverty) has been actively working to address this critical issue, responding to two key consultations by Ofgem, the UK’s energy regulator:

1. Improving debt standards in the domestic retail market

2. Resetting the energy debt landscape

Improving debt standards in the domestic retail market – Ali Vipond, Policy & Public Affairs Officer and Debt Advisor

With a significant amount of people in energy arrears across the UK, we’re pleased that Ofgem are considering what steps can be taken to prevent an ongoing energy debt crisis, recognising that people facing spiralling debt is not a short-term situation. Personally, as energy prices continue to rise, I continue to reduce the use of my heating, wear extra layers, use an electric blanket and try to work in the office as often as I can, to keep my energy bill affordable.

It’s encouraging to see that Ofgem would like to develop a debt outcome that guarantees high standards of care and customer service for people experiencing debt problems. CAP has offered great insights, particularly in how to support vulnerable consumers, considering a standardised provision of welfare teams across all energy suppliers is vital. Making monthly billing the default could improve awareness and prevent large arrears. Reducing the back-billing period to six months could prevent large debt balances from previous years.

We agree that clear advice for consumers and landlords regarding energy supply during tenancy changes is vital. We still hope that debt collection agencies and court action would be used as a last resort and ensure they conduct standardised affordability assessments.

A huge 42% of UK adults (22.4m people) have limited electricity or gas use in their house at least as often as once a month to cope with the rising cost of living.

It’s also encouraging to see that Ofgem plans to standardise and improve the consistency of ability to pay assessments. Ofgem recognises the need to review the whole financial situation for energy consumers, to enable suppliers to assess affordability for ongoing energy usage and debt repayments. We see a rising number of CAP clients that cannot afford their ongoing usage, let alone debt repayments. A major consideration, that we’re happy to see, would be moving consumers with energy debt on to the cheapest tariff, which would avoid a lot of stress and anxiety and hopefully help consumers to afford their ongoing usage. We also urge Ofgem and energy suppliers to introduce reduced tariffs, and implement debt solution schemes. This would benefit all parties by improving efficiency and reducing financial strain.

Ofgem is also aiming to improve working between suppliers, and consumer groups and charities. CAP, with other organisations, is urging energy suppliers to have dedicated phone lines and accept information from FCA-regulated debt advice organisations. This will help avoid unnecessary delays and further hardship for consumers. It is also essential for energy suppliers to accept third-party authorities from debt advice organisations, such as CAP, to avoid delays setting up repayment plans and preventing further collection action.

There is a shared ambition across the debt sector to develop enduring measures to help consumers achieve good outcomes and solutions to their debt problems.

Resetting the energy debt landscape – Kiri Adams, Head of Policy & Public Affairs

Encouragingly, Ofgem has listened to calls from the debt advice sector to intervene to help reset the energy debt landscape. This is a much needed intervention. The amount of energy debt held by suppliers has more than doubled in the last three years (up 118%), yet interestingly there are only 15% more customer accounts with debt over this same timeframe. Ultimately, this means those in arrears with their energy supplier are only getting deeper entrenched in debt, rather than any significant amount of new households falling into debt.

As the cost of energy has soared in recent years, Ofgem is wanting to provide a targeted intervention to help alleviate debt accumulated through this period of significantly high energy prices. Therefore, this will be a one-off scheme, hopefully being launched in Autumn/Winter 2025.

The two main components of the scheme are debt write-off and debt payment matching, where suppliers match the repayments made by their customers to help reduce the debt faster and encourage engagement. Ofgem is consulting on how to identify which customers should be offered which intervention, and how much should be awarded to individuals – deciding whether to try and help a lot with less, or a few with more.

One concern we have is how Ofgem wants debt advice providers to support applications to the scheme, in an already challenging landscape of high demand and low capacity – can debt advice organisations add one more process into an already complex picture? We also acknowledge that many low income households were struggling with energy debt before the energy crisis, and this one-off intervention is a good start, but a long-term solution to energy affordability for the lowest income households is urgently needed.

The energy market plays a vital role in people’s lives. CAP urges Ofgem and energy suppliers to carefully consider the recommendations outlined and to engage in ongoing dialogue with organisations like CAP to ensure that the voices of consumers are heard and their needs are met, particularly vulnerable consumers. Only through continued collaboration and a commitment to positive change can we create a truly effective and supportive system for all.

If you are struggling with energy arrears, please contact your energy supplier to discuss your situation.