We all know how important it is to handle money well. It’s one of those essential life skills that we all need. But when it comes to knowing how to teach kids about money, where do you start? It can be daunting to decide what age to start your child’s financial education, let alone what you need to cover.

Well, we asked the parents at CAP’s head office to share their favourite strategies for teaching kids about money. We’ve also included our free kids and youth resources to use with your children at your home, school or community group.

How to teach your kids about money:

1. Encourage a healthy attitude towards money

There are lots of practical lessons to learn about money, and we’ll cover those too, but a great place to start is to encourage children to have a healthy attitude towards money. Start by opening up conversations about money with our scenario cards, included in our free money teaching resources.

For older children, they might feel the peer pressure of having the next best phone or item of clothing. Talk to your child about ‘must-have’ items that they own, and open up meaningful conversations about why they wanted them and how often they’ve used them, to help them see that their friends might want different things to them.

We’ve been teaching our four about money from their earliest days. So far we’ve tried to show them what money is (i.e. a tool), what it’s for (i.e. it serves a purpose, it’s not something to acquire for its own sake) and that it’s important to be in control of it — rather than be controlled by it.

James Ross, Specialist Debt Advisor

2. Let them see how you plan your finances

Kids learn about money by watching and copying their parents, so why not show them what you already do? If you have a budget written up somewhere, or use an app to keep track of your finances, let your children see that you’re putting time and effort into managing your money. They’re likely to remember that when making their own decisions in the future.

3. Talk to them about budgeting

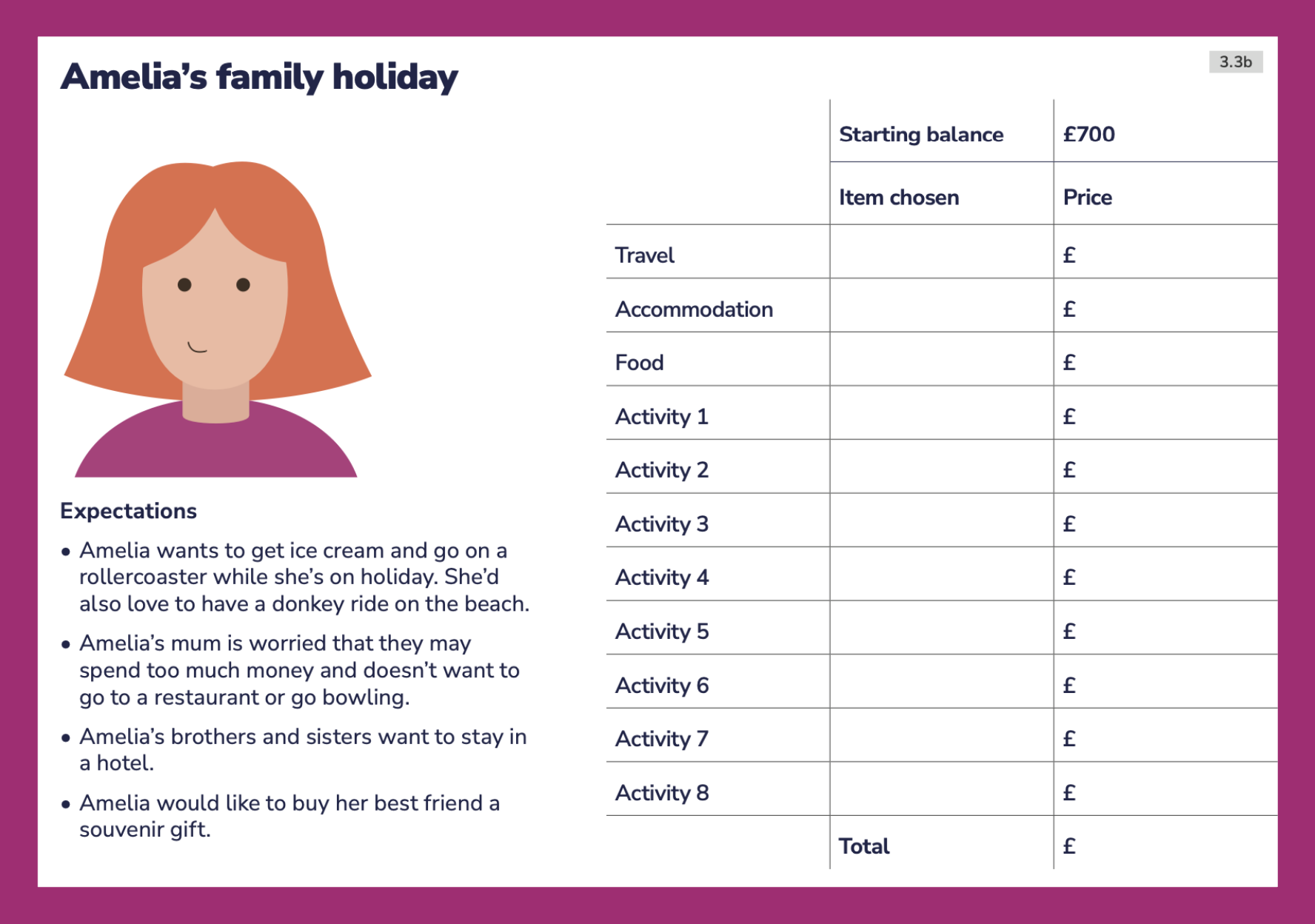

Sometimes it’s important for us to be reminded that it’s OK not to be able to buy our kids everything they want. It can even be an important learning opportunity for them. So don’t be afraid to talk about budgets, and the fact that money is a finite resource to be used wisely. Our budgeting worksheet for kids is a valuable resource to help consolidate learning.

I involved my daughters in talks about money from about aged 10/11. We talked budgets and savings, and they had pocket money. They now both have mortgages, and my eldest now has a daughter of her own, so managing her budget to cover everything they need has been easier.

Helen Ganney, External Affairs Manager

4. Let them practise handling their own money with digital tools

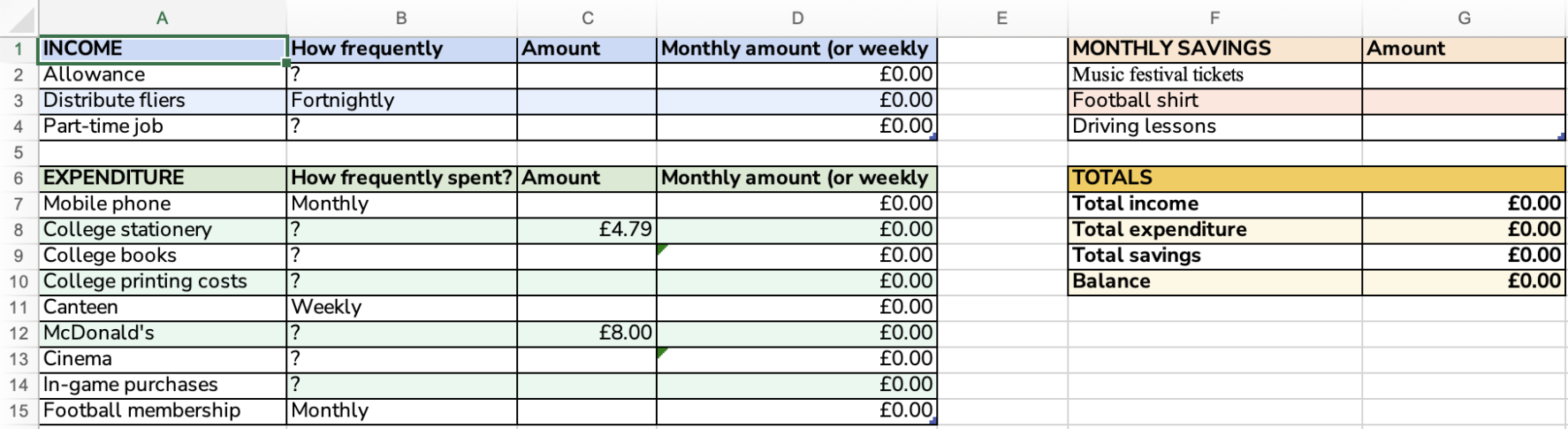

One helpful way to teach your child about money and budgeting is to explore child-friendly digital tools. You can use financial apps where you can track your child’s spending on a debit card, or let them create their own spreadsheets to help them practise handling money.

Included in our money resources for kids and youth are realistic, editable budget spreadsheets like this one below, helping older learners get hands-on experience of handling money.

5. Help them learn to save up for the things they really want

As it gets easier and easier to ‘buy now, pay later’, one really useful skill to teach our kids is how and why to save up their money. You might decide to help them motivate them to save with a savings tracker, and help them work out how long their savings goal will take.

We involved our lad in money conversations from a young age. When he wanted to buy a particular toy, we would discuss whether it was worth it. Then agree to wait a couple of weeks, save his pocket money and buy a better version of it. He got a better toy, and learned the value of money and saving. Make sure to praise your child when they reach their goal!

Steve Camps, Senior Debt Advisor

6. Pocket money can be a useful tool

If your family does pocket money, this can be a great way to practise those essential saving principles. Make sure to talk with your child about what they plan to save up for and how they want to spend their pocket money, to help build confidence in saving and spending. For older children, you might want to increase their spending money to let them budget for their essentials, like toiletries, social activities and clothing.

We have a 9‑year-old and have done pocket money for two or three years. It really helped with the asking for things because the standard reply is, “yes, you can save for it with your pocket money”. Having pocket money teaches her so much like the value of money and that if you are patient, you can save for what you want.

Nathan Davies, Senior Debt Advisor

7. Give them some responsibility to choose how money gets spent

Finally, don’t underestimate the power of giving kids a bit of (age-appropriate) responsibility. If they’re old enough to understand budgeting, why not put them in charge of deciding what to buy for dinner this weekend, or for a day out with the family?

So there you have it: seven ideas for teaching kids about money so that they grow up equipped and confident to manage their finances. Have you tried any of these strategies with your own children? Do you remember what your own parents taught you about money? Let us know what has worked well for you.