Being a student isn’t cheap. Between juggling your rent, tuition fees and making sure you don’t live on instant noodles, it can be really easy to watch that money leave your bank account as soon as it hits. If you’ve been following our student blog series, you’ll know that we want to help you take control of your finances.

Whether you’re new to budgeting or just looking for better ways to save, this blog will give you some tips on how to budget like a boss. So, grab a cup of tea or coffee, and let’s dive right in.

Budgeting apps and tools to use at university:

1. Budgeting apps

As a student, it can be really easy to avoid checking your bank accounts. Mobile budgeting apps can reduce money-related anxiety and help you feel in control.

Snoop’s free version lets you view all your bank accounts in one place, get daily balance updates, and see your spending habits categorised. Other free perks include:

- spending analyses

- weekly reports

- subscription tracking updates

- reminders of when your bills are due and subscriptions need renewing

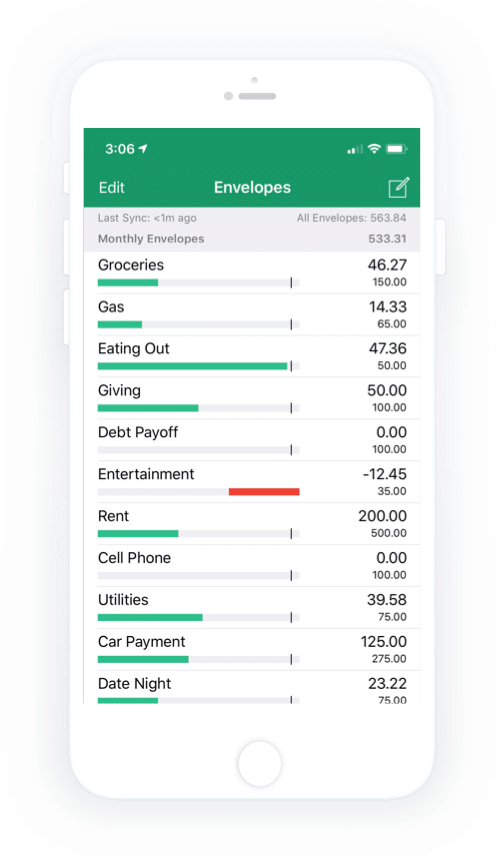

Goodbudget is based on the classic envelope system (allocating different amounts of money into categorised envelopes). This budgeting app uses this system but without the physical envelopes, making it a great option for students. The app’s free perks include:

- ten regular envelopes

- ten more virtual envelopes to use

- not having to link the app to your bank account, helping you plan your spending rather than track it

Snoop and Goodbudget are just two student budgeting apps, but there are plenty more out there to help you track your spending. Make sure to read each app’s features to find the best one for you, and remember that some charge subscription fees.

2. Cashback websites

As a student, you’ll probably be spending some of your spare cash on any personal items that you need, and cashback websites like TopCashback and Quidco can help you build up money for free. Since you’ll likely be in a deficit budget at university (meaning that your outgoings will be greater than your income), any extra cash you can get can be really helpful.

So, how do cashback websites work?

They track what you spend online: you’ll need to go through the website or app first and click the link to your chosen online retailer or shop. Although it’s a great way to get a bit of extra money, there are some key things that you’ll need to keep in mind:

There can be tracking issues, meaning that your free money isn’t always guaranteed, even if you try to make a claim for missing cash.

It can take time to process the cash through to your cashback account, and it isn’t yours until it’s been withdrawn to your bank account.

Focus on the best deal, not the best cashback. It can be easy to choose a deal or buy something online based on the best cashback deal, but we’d recommend instead choosing the best deal that you can.

A TopCashback membership is free, but make sure to downgrade from the ‘Plus’ membership when you first sign up.

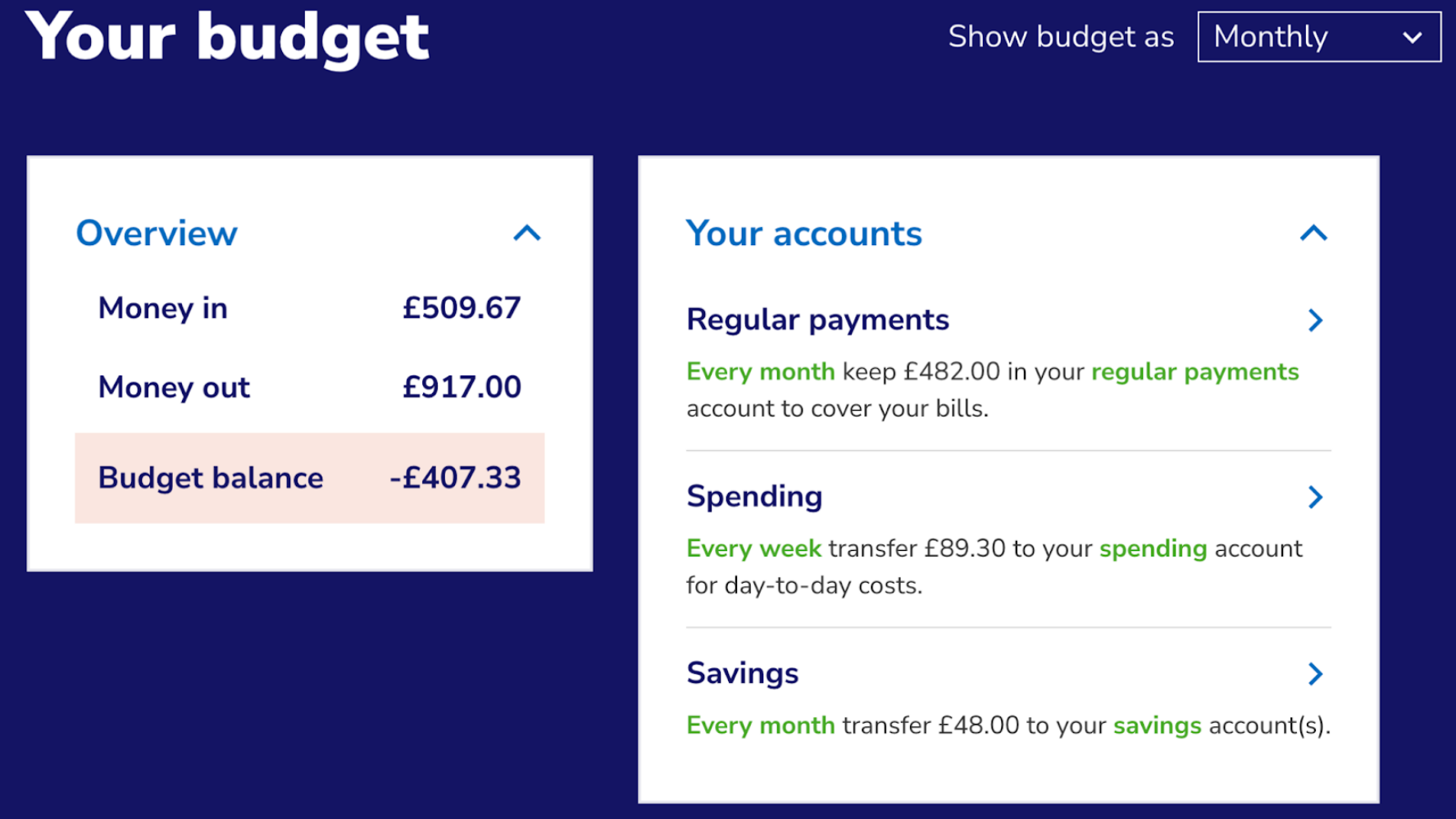

3. Money coaching portal

If you’re looking for a free budgeting web portal, look no further than the money coaching workshops. Not only do the workshops give you the skills to budget, but you’ll also have the opportunity to log into the online portal and use the interactive budgeting tool. This budgeting tool does all the hard work for you; simply pop in your income and outgoings, and it’ll help you plan your payments and budget.

4. Apps to shop smarter

Olio is a brilliant way to get free items for university, and give away things you don’t need, and make connections with people in your local community. Before thinking about buying a new item, check Olio first to see if someone’s giving it away for free.

For those items that you do need to buy brand new, Karma’s free Chrome extension uses AI to help you shop more mindfully. You can save items for later to avoid impulse purchases, compare deals, and automatically get coupons added to your basket.

Food shopping at university can be expensive, and as a student, you might want to cook simpler meals with fewer ingredients to avoid food waste. Too Good To Go is a social impact company, meaning that you can grab a food bargain and also help save the planet. Simply log into the app, set your location, and see which food bags you can buy from supermarkets, restaurants and cafés local to you at a discounted price (usually half price or less).

Before you go…

We hope these student budgeting apps and tools are helpful for you as you head off to university. Don’t forget that if you ever need more support, we’re here for you at CAP, and you don’t have to be a Christian to get free debt help or money advice from us. Simply get help near you.

Why not keep in touch? Follow us on TikTok, Instagram, Facebook, X and LinkedIn to stay in the loop and get more free resources and money advice. Why not tag us and let us know how you’re budgeting during university? We’d love to hear from you!